The LUSD Ecosystem: services & strategies

TokenBrice

February 3, 2023

LUSD Ecosystem Overview: services & strategies

LUSD can already be borrowed on Liquity using an ETH collateral with high loan to value and very reasonable borrowing fees, especially for long-term borrowing, so why bother adding LUSD on the various money markets of DeFi?

It’s a question we get quite a bit, and we definitely understand where it’s coming from. Integrating LUSD as a borrowable asset on money markets can seem redundant when LUSD can already be borrowed directly from the Liquity protocol! without some understanding of the dynamics affecting LUSD.

2022 was an amazing year for the LUSD ecosystem as LUSD gained more than 5 new additional integrations either as a borrowable asset or a collateral: Aave, Mimo, Angle, Silo & GearBox.

So with this article, we’ll deep dive into the benefits that come with the addition of LUSD as a borrowable asset on third-party lending services, and also the cases where LUSD is used as collateral too. For each service, we’ll also provide you with contextualized example strategies demonstrating what the diverse features of the borrowing services enable.

There are currently three main types of use cases related to borrowing/using LUSD as collateral on money markets:

- Borrow LUSD with different conditions (compared to Liquity protocol): borrowing LUSD on money markets like Aave can be done with a wide range of collateral, and different borrowing terms (interest rate).

- Use LUSD as collateral: harness LUSD as collateral for fx arbitrage strategies, to offramp €, or even to go long on LUSD’s peg.

- Liquidity providers leveraging for better yields: users looking to borrow using a LUSD LP collateral to leverage the yield of the position and output a better yield.

All three use cases have their own specific objectives, harness different venues, and enable their own kind of strategies. So in this article, we will detail all three, let’s dive in!

I/ Borrow LUSD on different terms (compared to Liquity)

While the Liquity protocol itself is the primary venue used to mint & borrow LUSD, there are several benefits to having LUSD as a borrowable asset on money markets such as Aave where it’s currently available.

Indeed, even if the Liquity protocol offers the most favorable terms to borrow LUSD, especially for long-term borrowers thanks to the absence of interest rate, it also has some limitations for LUSD borrowers compared to Aave:

- Liquity accepts only ETH as collateral, which is great for LUSD’s resilience yet also restrictive for the borrowers. Thanks to the availability of LUSD as a borrowable asset on Aave, it’s now possible to borrow LUSD using any of the collateral they support, such as wBTC, various stablecoins, or supported volatile ERC-20 tokens.

- Liquity charges no interest rate, making it the most cost-effective venue for long term positions. Indeed, the 0.5% initiation fee is cheaper than 2% borrowing APY as soon as the position is held for more than three months. However, this initiation fee is unfavorable for short-term positions, such as just a few weeks, where an interest rate is preferable to reduce the effective cost of borrowing.

Thus, if we connect 1 & 2, we clearly understand the benefits for LUSD. Having LUSD borrowable on Aave enables DeFians to open a short position on LUSD over a short time frame, using any collateral supported there: Aave are essentially democratizing access to the short LUSD peg trade – both in terms of collateral and timeframe.

Example strategy: Short-term LUSD peg shorting

A centralized stablecoin just went burst, and the whole market panicked, pushing LUSD to 1.06 as it is seen as one of the few safe havens. Markets are uneasy, tokens are dumping, stables are depegging: most investors are growing weary, most, but not Bob.

Indeed, Bob knows the drill, he has seen this happen before, like when UST imploded. He knows what follows: the premium will sustain as long as the panic is strong and then should resolve quickly. He doesn’t own ETH, but this time it won’t prevent him from taking the trade. Bob is determined to short the LUSD peg.

So he supplies USDC to Aave in order to borrow LUSD, which he proceeds to sell instantly to secure the current price, ideally to USDC. If he feels game, he can even repeat the loop several times.

Bob’s price target is LUSD back at $1.02, where he decided to close the position to secure the profits earned. The funding rate of such a position is quite moderate, thanks to EUL incentives on LUSD borrowers: currently, Bob would pay a 3.71% borrowing APY (accrued in LUSD), but earn a 2.93% EUL APY on its amount borrowed, meaning the effective interest rate is below 1% over the year.

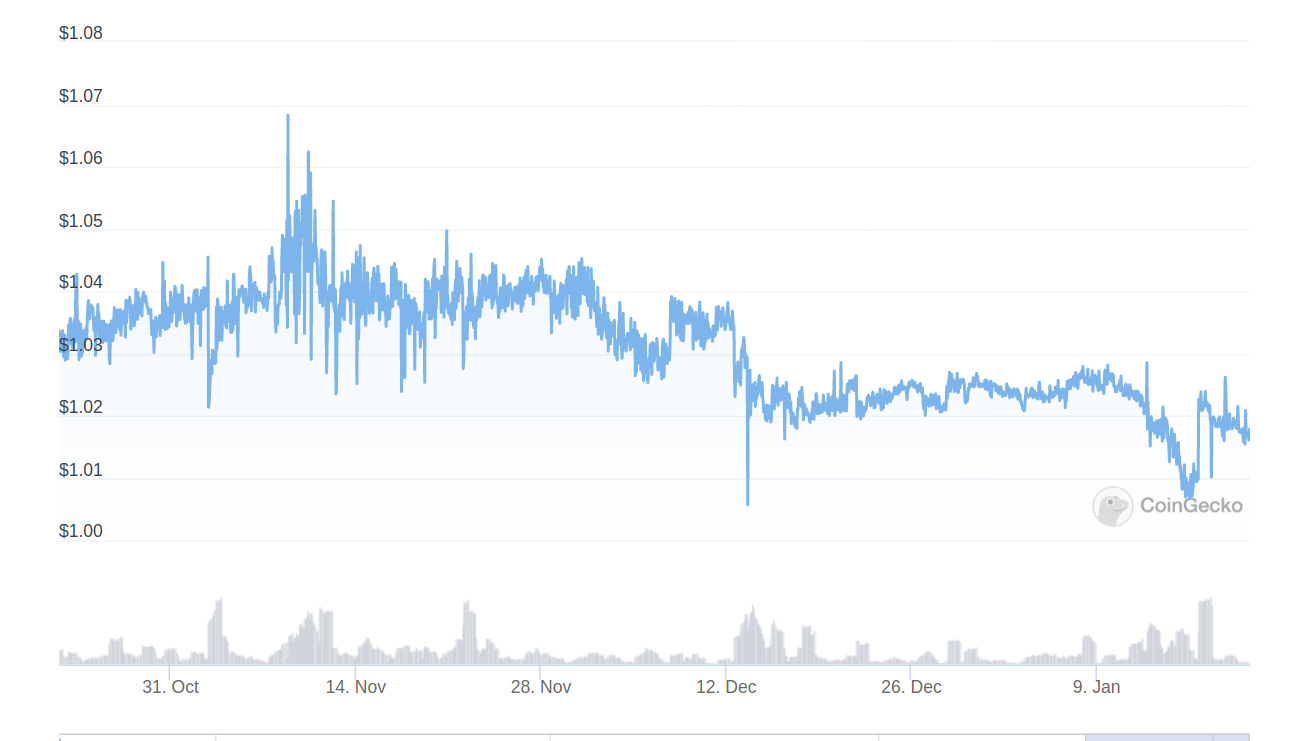

Bob’s profits will be greatly influenced by the time it takes for his prediction (LUSD back to $1.02) to realize. Looking for a similar spread in the LUSD historical price data, it seems like the last time the gap took about 1 to 3 months to resorb itself:

If he took the trade back in early November, he would have seen already two windows with LUSD <$1.02 enabling him to close the trade and secure profits within less than 3 months, meaning he would have secured ~5% returns in less than a month on his stable if he sold on Dec 12 (~60% APY) without using any leverage.

Seems like it pays to understand other actors' fears and act with a plan while they run like headless chickens.

II/ Using LUSD as collateral

LUSD is arguably the most resilient stablecoin on the Ethereum network. Its resilience, on top of its stability, makes LUSD a very desirable collateral to have, especially for other borrowing services that accept a wide range of collateral including trust-required and centralized tokens like USDC, wBTC or DAI. Indeed, adding LUSD to their collateral roster enables them to reduce their dependence on centralized and censorable tokens.

LUSD has yet to attain collateral status on a tier 1 money market, but it’s already supported as collateral on Angle and Mimo, both offering depositors the option to borrow an €-based stablecoin, respectively agEUR and PAR. It was also recently added to Silo Finance, where it can be used to borrow either ETH or XAI ($-based stablecoin).

The table below recaps the three main services supporting LUSD as collateral and their borrowing parameters:

With the stage set, let’s explore the various strategies one can harness using LUSD as collateral.

PS: This article focuses on LUSD, so we won’t detail strategies using it but it’s worth noting that LQTY is also supported as a collateral on Silo Finance, with 50% max LTV.

Example strategy 1: (Leveraged) Short € using LUSD collateral

This strategy is essentially a forex strategy, where you’ll take a directional and potentially leveraged bet shorting the Euro against $: not the best idea over the last 6 months, but it was an ace trade 2 years before that — timing is everything!

Jean Baguette is a French DeFian: yet like most, he owns mostly $-pegged stablecoins, as well as some RAI. Jean recently started living off his DeFi yields produced by his stablecoins. Since he spends Euros in his day-to-day, he decided to switch a share of his stablecoin bag to € to protect himself from the impact of the €/$ price fluctuation on his living expenses.

It’s working neatly for him, but with the progressing vassalization of the European Union, Jean worries the € might depreciate further in the future. So he decides to hedge his €-stable position with a LUSD-collateralized € short position. He deposits LUSD on Angle to borrow agEUR, and sells them for more LUSD or another dollar-pegged stablecoin.

Depending on his timing, his hedge might also have proven quite profitable! Indeed, the spread on the forex market is getting bigger lately: between May 2021 and October 2022, Jean could have sold his € for $1.23 and re-bought them at $0.97 for a ~27% return over 17 months, without leverage.

Just like with the LUSD-peg short using Aave, here leverage is possible, too. If Jean sells the AgEUR borrowed for more LUSD, he can increase the collateral deposited to borrow more and increase his exposure. Here again, the funding rate of the strategy is quite reasonable since Angle only charges a 0.5% interest rate.

Whenever Jean is happy with how low the current € price dropped against the $ (thanks M. Lagarde for your services), Jean simply needs to purchase agEUR to repay his debt and recover the LUSD used to collateralize the position.

Example strategy 2: Offramp € using ETH collateral

Another prime interest of having LUSD as collateral relates to off-ramping. Indeed, thanks to having the most competitive fees ever, by a very wide margin, Liquity is ideal for long-term positions, such as borrowing to cover a real-world expense (like buying a house) to be repaid only years later.

Since Liquity charges no interest, the Trove can be kept open for years without piling on interest like it would have on Maker or Aave. So let’s go back to Jean Baguette, and imagine his farming went well. Jean accumulated a sizable ETH bag he doesn’t intend to part with.

However, Jean would like to buy a house. So he decides to nest two borrowing positions to be able to purchase a house (paid in fiat-€) while using his ETH as collateral.

- Deposit ETH on Liquity, borrow LUSD (0.5% one-time initiation fee)

- Deposit LUSD on Angle, borrow AgEUR (0.5% yearly interest rate)

- Swap agEUR to jEUR, offramp jEUR

- Buy the house

- Re-pay Angle’s loan over time

- Recover his LUSD collateral once Angle debt is cleared, and pay back the Liquity debt to free Jean’s precious ETH stash.

Of course, for such a long-term strategy, it’s preferable to have a sizable margin of error on the LTV, or commit to an active monitoring of the position if aggressive in leverage.

Note: What follows is not legal advice, but depending on your local jurisdiction, such a workflow might result in more favorable tax conditions than a direct offramp of ETH. Indeed, here the funds' offramp comes from a loan, and they are denominated in the same currency as the one received, so there are no profits on the €-stablecoin ⇒ € offramp.

Example strategy 3: (Leveraged) Long LUSD Peg

Unlike Bob, Laura is confident the LUSD price is about to skyrocket — indeed Laura is a crypto-lawyer and had the chance to see an upcoming bill that will enforce stricter control and limitations on centralized stablecoins. She’s convinced the market is likely to panic at the announcement of the new law and would like to position herself to make the most of it.

So Laura essentially takes the exact opposite approach (and bet) of Bob: where Bob shorted the LUSD peg, Laura is going to long it. To do so, she needs a venue where LUSD can be used as collateral, ideally to borrow a $-based stablecoin to avoid an unnecessary layer of price risk. Thus she deposits LUSD on Silo Finance, borrows XAI, and swaps XAI back to LUSD to lever up her position.

Silo Finance has variable interest rates, depending on the market utilization, similar to Aave or Compound. Therefore Laura’s borrowing costs are hard to predict accurately here. The process to implement the strategy is very similar to the one of Jean, only the services used and the direction of the trade are different:

When LUSD is still ~ $1.02:

- Supply LUSD on Silo Finance

- Borrow XAI & swap it for LUSD

- (If leveraged is desired) Deposit the newly obtained LUSD and repeat 1+2 as much as needed to achieve the desired leverage.

Once LUSD will have reached Laura’s price target ($1.06), she can simply close the loop and pocket her profits by withdrawing the LUSD and selling them for another $-stable at a hefty premium. A flashloan would make things easier for Laura here, enabling her to close the position in one optimized and efficient transaction.

III/ Leveraging LUSD LP positions

So far, we’ve stuck with borrowing services harnessing a simple pool model like Aave or CDP-type services such as Mimo or Angle. Yet 2022 was prolific when it comes to borrowing services, and novel leveraging offerings appeared.

Indeed, so far all the services we mentioned above rely on overcollateralized loans, just like Liquity. Yet DeFi is making strides, and it’s now possible to borrow undercollateralized under certain conditions, using a protocol such as GearBox.

GearBox harnesses a smart contract wallet (Credit Account) to restrict what can be done with the borrowed funds, enabling it to provide undercollateralized loans without risking default. Various collaterals are supported, including the LUSD/3CRV Curve LP token (cvx version): GearBox users are able to borrow stablecoins/ETH/wBTC (depending on their collateral) to lever up a productive position up to 10x.

Example strategy: Leverage LUSD/3CRV yields

The strategy here is straightforward: an LUSD/3CRV LP is looking to increase the yield produced by his position.

Strategy implementation

Chad is a LUSD liquidity provider, happy to further grow his CRV/CVX stash thanks to his LUSD position. Up until now, he was using Concentrator to optimize the management of his LUSD/3CRV LP position: all the yields are frequently claimed and compounded into aCRV, a cvcxCRV wrapper.

However, Chad heard about the newly released GearBox protocol and he quickly understood that he could supercharge his yields even more harnessing it. Indeed, GearBox enables him to leverage his LP position, undercollateralized. Of course, it comes with a cost (borrowing interest rate), so Chad’s effective profit is the difference between his borrowing cost and the additional yield he’s able to secure with every loop (up to x10).

The execution of the strategy is quite straightforward:

- Supply Curve LUSD/3CRV to obtain crvLUSD-3CRV LP tokens

- Deposit the LP tokens on Convex (NO STAKING) to obtain cvxLUSD-3CRV

- Deposit cvxLUSD-3CRV in GearBox Credit Account

- Choose the leverage and execute

- Enjoy boosted yields

ℹ️ GearBox is still under a controlled launch phase and access the borrowing service is restricted: one must be a ninja to borrow on Gearbox — learn more here.

To learn more about how to harness GearBox with LUSD, check out our previous GearBox-focused article.

Note: while this article covers the main venue supporting LUSD, it’s not fully exhaustive. There are others, riskier venues supporting LUSD and even bLUSD as collateral: uWU Lend.

We strongly advise the uttermost caution to anyone considering using it.

Key Takeaway

We hope this article helped you better understand why adding LUSD as a borrowable or collateral asset on money markets and lending services of DeFi is desirable. Even if you don’t harness the strategies presented above yourself, know that they help to stabilize LUSD, increase its liquidity and trading volume and enable new use cases.

Meanwhile, the integration effort around LUSD is not stopping here and there’s more where they come from:

Next Integrations for LUSD

As said in the introduction, LUSD gained almost one relevant DeFi integration per month in 2022. The effort will keep on going, with several avenues:

- Aave v3 is coming to mainnet shortly and with it eMode! Further governance proposals should enable LUSD as collateral + eMode against other stablecoin >95% LTV.

- On the Optimism network, LUSD liquidity has grown to >$5M, enabling further use cases such as lending. Several lending-related integrations for LUSD have been held for months, waiting for Chainlink to supply an oracle which was just obtained: a flurry of integrations for LUSD on Optimism is coming!

To keep track of the opportunities available in the LUSD ecosystem, join the Liquity Discord server. You’ll find channels there recapping the main integrations for liquidity, lending, and layer 2.